This page added on Monday, 6th October 2008

No, it's not, actually - it's a phenomenon called crepuscular rays

which appeared over toward Mount Barrow on Saturday, 5th April this year. I

was quick enough to get some shots while the effect lasted. (This was taken

looking east from my front garden.)

I've seen these before on occasion, and been baffled by them. (I used to

think that the sun's rays were in some weird way undergoing extreme

refraction while passing through the lower atmosphere, but I know better

now.) It looks for all the world as though there is indeed a large and

mysterious object up there, shining a wide, diverging beam of light down

through a break in the clouds. Incongruously, the four words which always

come to mind when I see such a thing are "Beam me up, Scotty!"

It's an illusion, of course. The sun's rays are shining above the clouds,

and then ultimately down through the hole, at a fairly shallow angle - not

straight downwards at all! (Note, however, that there is nothing else

illusory in this picture - in particular, the hydroelectric pole which has

by now become familiar from other pictures within my website, most recently

in

this page.)

To see a good explanation of crepuscular rays, click

here

or

here.

To see some other striking pictures taken in various parts of the world,

visit

this page.

So what's my angle

(pun intended

While illusions may be interesting, or even beautiful, basing one's life on

them can lead to disaster. As George Harrison said in his gorgeous song

"Beware of Darkness"

(from his 1970 triple album "All Things Must Pass"):

Beware of Maya...

If you've browsed through this website before, you may know that I've

made reference to that song in an

earlier page

(about three-quarters of the way down). However, I make no apology for

mentioning it again, because it is now more relevant than ever. As I pointed

out then, "Maya" is a Sanskrit word which means "illusion".

It's taken a long time; but finally, it seems, the "financial world" is

starting to wake up to the colossal damage it has inflicted over these past

several years.

If you've visited either of my web-pages whose links appear above, you'll

know that one of the major themes of this site has been an attempt to draw

attention to these matters. So can I reasonably claim that my "rants" have

had much effect - or, indeed, any at all?

I don't know. Probably not; since I launched the site in July 2006, my home

page has scored only some 1,700 hits. So it would probably be just hubris

for me to suggest that I've had a major input into the "debate". However, on

a personal level, may I say that I find the feeling of vindication

very welcome.

I was just eleven years old in 1964 when the movie "Mary Poppins" screened

at Launceston's drive-in theatre (remember drive-in's?). As I'm sure you

know, it's the story of a "magic nanny" who had the ability to fly using her

umbrella as some kind of flying-machine-cum-parachute and to slide up

bannisters, among many other neat tricks.

On one level, it was a kids' film; but on another, it had plenty of in-built

wit and wisdom for their parents (much as A.A.Milne's "Winnie the Pooh" can

be read at two levels). As it turns out, Mary P.'s mission is not so much to

be a governess for two lively children (Michael and Jane) as to sort out

their mixed-up father, Mr. Banks, who (of course) works in a bank.

There are many striking scenes in the film, but perhaps the most startling -

even for eleven-year-old me - was the one in which Mr. Banks takes the kids

to his work-place, to try and impress upon them the need for prudent

financial behaviour. Michael has two pennies (the old English term

tuppence is used) with which he wants to buy bird-seed to feed some

of London's pigeons. (Now why does that remind me of

Nikola Tesla?)

One of the film's famous songs is all about this: "Feed the birds, tuppence

a bag..."

Oh no, say the sensible, responsible adults, you ought to invest your

tuppence. At a critical point, the bank manager snatches the two pennies out

of Michael's open hand, making a short "welcome" speech. Michael's shocked

response is:

"GIVE IT BACK!!!"

When other bank customers hear the kerfuffle, panic sets in, as they gain

the impression that the bank is refusing to give someone their money. They

demand that the bank immediately hand over all their money - and the bank

promptly shuts down all the tellers' windows. A "run on the bank" - very

dramatic, and quite frightening in its own way.

I want to move on; but first, may I invite you to have a good, hard look at

what another commentator has to say about this, by clicking

here

and then scrolling down a bit until you find the Mary Poppins picture. (You

can't miss it - look for the behatted umbrella-and-carpet-bag-wielding

flying lady, against the background of lots and lots of old-fashioned

English chimneys.

When I was at university in the 1970's, it was my ambition to become a

mathematics teacher (which did indeed happen). I did a Bachelor of Science

(B.Sc.) degree, with a major in pure mathematics, followed by a Diploma of

Education (Dip.Ed.).

Most of my uni. friends were doing either science or arts, many with the

intention of also becoming teachers. There was a fair bit of more-or-less

good-natured ribbing beween the two camps: the science students viewed the

arts as basically "waffle" and "soft options", while the arts students'

point of view was that we science-types were simply getting a

training, rather than an education.

To be sure, others in my circle of friends were doing engineering, medicine,

or agricultural science, all of which I could relate to. There were also

some nurses (in those days nursing training was hospital-based, rather than

university-based); but if I'm honest, I'd have to admit that it was the

nurses per se, rather than what they did, that interested me.

I was also aware of such things as law and economics. No-one I really knew

well was doing law; but a few friends were indeed studying for their B.Ec.

degrees. It was all a bit of a mystery to me. How could anyone find anything

particularly interesting in talking and thinking about nothing but money?

At the men's residential college where I stayed for some of my uni. career,

people you disrespected were often known as "wackers". (By replacing one

letter with an "n", you'll arrive at another word which is now more common

but which has much the same meaning.

So I didn't take too much notice of economics. (At a pinch, I'd have been

more interested in law.) I never thought I would have to be very much

bothered with such matters.

Silly me. If only I'd known. Now the world is run by the economists - and

just look at the mess they've got us into.

Even I, the "mad scientist", knew there was trouble coming. When I wrote my

"new millenium"

page back in March this year, in the wake of Australia's change of federal

government from John Howard's conservative régime to Kevin Rudd's Labor, I

alluded to such matters as interest rates and the US's sub-prime mortgage

crisis, suspecting that we were all in for a rough ride. I was right - the

bubble was finally bursting.

It was like something out of a comic strip - except that it wasn't funny.

Big financial institutions with goofy-sounding names like "Fannie Mae" and

"Freddie Mac" were in real trouble. The term "bailout" has come into common

parlance; click

here

to see a relevant ABC News article published on 8th September. That was

just under a month ago; and still the news is full of the continuing fiasco.

A brief digression, if I may - in 1984, US folk singer Arlo Guthrie toured

Australia with the band Shenandoah. They performed in Adelaide and Sydney;

the concerts were broadcast over ABC-FM radio, and I was fortunate enough to

hear them. One of the songs was Tom Paxton's "Changing My Name to Chrysler".

It's all about bailouts; click

here

to read the lyrics. Fun - but deadly serious, too.

UPDATE, 25th December 2008 (that's right - Christmas day!)

My original Windows 95 computer "died" over a year ago, and I've been using

a Windows 98 machine ever since. (So don't call me a "Luddite", OK?!

ANYWAY, the point is that I only found out a few days ago - almost by

accident - that it's actually possible for me to run a good enough version

of Flash to view YouTube videos and similar. It's opened up a whole new

vista for me - what fun!

Just a few days ago I posted my new page about Christmas

(here,

if you're interested). While hunting for an Arlo Guthrie video link to

include there, I also found a link to an excellent video of him (with

Shenandoah) performing "Changing My Name to Chrysler". Click

here

to see it - it's a ripper.

- And of course, because of the much-vaunted "global economy", the whole

world is affected. The global stock market doesn't appear to know what to

do; to use a phrase first coined (to my knowledge) by former Australian

Prime Minister Bob Hawke, it's "up and down like a toilet-seat".

It's not my purpose here to give a blow-by-blow description of what's

happening, or to predict how (if at all) it's going to end. I simply wish to

make the point, again, that it's basically down to one thing:

GREED

It does have its comic aspects, though. Who'd have thought that words like

"socialism" would be bandied about regarding the US administration's bailout

of the banks?!

Just one example: Have a look at

this

web-page. Note: I'm not getting involved with this debate one way or

the other. To me, "socialism" is just another "ism", along with "capitalism"

and "communism". In the final analysis, words are just words; it's

ideas that matter.

What's really interesting about all this is that, finally, we're hearing

media reports that actually sound as though they make sense to the ordinary

person. A spade is being called a spade. Odd terms like "short selling" are

being explained to us lesser mortals in words we can actually understand -

and be horrified by. Best of all, "credit" is actually being called by its

real name: DEBT.

Just maybe we'll all come out of this a lot wiser, if somewhat poorer

in monetary terms. Perhaps the public won't be bluffed so easily in future

by the "spin-language" of the greedy financiers. But I don't think we're

there yet.

In Australia, over the last few days, there's been talk of an interest rate

cut. But there's a catch. Have a look at

this article.

That's right - the Governor of the Reserve Bank and the Prime Minister,

bless 'em, agree about an official interest rate cut of 0.5% (WOW!) -

but don't want to put pressure on the banks to "pass it on" fully to their

customers! How about that?

Is it because the banks, poor darlings, really can't afford to give their

long-suffering customers a break? Give me a break!!!

There is the beginning of public anger about this. People are very cynical

about how interest rate hikes are passed on immediately, but

cuts - if and when they occur at all - can apparently only exist "on

paper", if it suits the power-brokers' ends.

But what's really intriguing about this is that the federal opposition - the

remnants of John Howard's former government, basically - have taken up the

matter and want the cut passed on in full to the beleaguered public! How

about that? - from former members of the highest-taxing government in

Australia's history, less than a year ago? (Click

here

to read more.)

"Strange days indeed - MOST peculiar, mama!"

At the end of next month, it will be a year since Kevin Rudd's federal Labor

Government took office - with a bit of help from yours truly. I'm thinking

of giving them an "e-report card", right here in this website. Stay tuned.

Earlier in this page, I mentioned the movie "Mary Poppins", and provided a

link to another commentator on the movie.

(

Here's

the link again, for convenience.) In that page, the author makes the point

that banks need their customers' confidence in order to function; and

that without it - as in the case of young Michael Banks - they cannot

operate. Perhaps the banks should take note of that, and just pass the

interest rate cuts on, regardless of what the "shot-callers" say - because I

don't believe that the public are going to have any more confidence

in illusion (i.e. Maya; see above) - or what I prefer, in this context,

to call "hot air and BS" (and you know what BS means).

So what can I say about the global financial system, from my own

perspective?

Well, I've already had quite a bit to say on the subject in several pages

within this website, including those whose links appear in this one. In

fact, around 2000, when it was just starting to become a major issue, I

wrote an angry song about it called "The Loan Sharks", which you can see

(and hear) by visiting

this page.

I'm still trying to get my head around it, and crystallize my thoughts.

This page represents my most recent thinking about the matter. I don't

intend to stop mulling over it for as long as the need persists.

I'll be honest: my heart says that I'd like it simply to die ASAP, and be

completely rebuilt from the ground up, with ordinary citizens the big

winners and the financiers very tightly reined in, with tough legislation to

enforce strict controls on their activities and harsh penalties for those

who don't measure up. (I cheered when I saw on my TV screen, a few nights

ago, US protesters holding placards saying "JAIL THEM -

DON'T BAIL THEM".)

Also, international safeguards should be built in to ensure that if one

country's economy goes "belly up", other countries are insulated from the

effects. Most importantly of all, however, no individual country's autonomy

as a nation should ever be subservient to any kind of world-wide

economic system. The overreaching global economy, in its present form, is

quite simply an abomination.

On the other hand, my head says that the required changes probably won't -

and couldn't - really happen in quite so traumatic a manner. Major surgery

is needed, and the ends I've just espoused must happen - but it will take

time.

I just hope the world learns from the current crisis - that the financial

markets (including banks and stock exchanges) can no longer be allowed to

continue on their merry way, peddling nothing more than "hot air and BS".

That's OUR money they're playing with, and they need to be held accountable.

What worries me is that, over time, people will forget. As I mentioned in my

Why is Mad Teddy mad?

page, a third of a century ago my generation didn't finish the job we'd set

ourselves, and thought we could just take it easy ("She'll be right, mate!"

is the classic Aussie expression); and now we're paying the price for our

lack of focus.

Is it really too much to expect the world's people not to forget the current

lunacy, and resolve never to tolerate it again? - To really "Beware of

MAYA"?

I wonder.

While researching this page, I ran across a web-page which discusses the

place of outfits like the International Monetary Fund and the World Bank in

all this. Well worth a read; click

here

to do so.

I ended my

"new millenium"

page (mentioned earlier) with this quote from a

song

by Jimi Hendrix:

...castles made of sand

Perhaps. Although I'd never have thought so at the time, the 1986 movie

"Mad Max - Beyond Thunderdome" contains a wonderful Tina Turner song which

I think captures the mood I'd like to express here.

Some of the lyrics from

"We Don't Need Another Hero":

"Looking for something we can rely on -

UPDATE, Tuesday 7th October

Well, I don't think I've ever before updated a web-page so soon after

posting it! I only put this on the web last night, and I've just watched

the ABC-TV Midday News - so that's quite a bit less than 24 hours later.

But, as the saying goes, "it's all happening..." - so here I am again.

Two items:

Firstly, the big bailout clearly isn't working. The stock market is going

down, not up - and quite dramatically. US President George

W. Bush was on the telly, saying "Restoring confidence will take time".

Well, credit where it's due - he got that right, even if it is simply a

case of stating the "bleeding obvious"!

Secondly, our Prime Minister, Kevin Rudd, was also on the box, defending

his decision not to insist that the banks fully pass on the new interest

rate cut to the public. It seems that it's too early to Google any links

to the story yet; but I did find

this link

to a page in "The Australian" newspaper's website, in which Kevin Rudd is

reported as saying essentially the same thing late last week. Have a look.

That page was posted last Friday, 3rd October 2008 - just four days ago.

The story starts as follows:

"K[evin] Rudd has stared down criticism of his refusal to insist banks pass

on in full any cut in interest rates, saying his job is to ensure the

health of the financial sector."

WRONG. Kevin Rudd's job is to be the Prime Minister of

Australia, not to take the side of the banks against the

interests of the Australian people!!!

These are indeed strange days. Never in my wildest dreams did I imagine

that I'd be championing a statement by a lame-duck Republican US President

over one by an Australian Labor Prime Minister for whose new government

I voted less than a year ago.

It's very simple. The answer is to be found in the "Mary Poppins" story.

If politicians, public servants (and I'm thinking very specifically of

the Reserve Bank Governor), and the financial sector's leading figures

want to restore confidence, they are going to have to start

treating the public with some respect - because there is no other way

they'll ever regain it.

- And the matter is urgent, because the stakes are high. As young Michael

Banks said:

"GIVE IT BACK!!!"

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

SECOND UPDATE, Tuesday 7th October

Well - I can't believe this. I've just watched the evening news, and it's

not a measly 0.5% interest rate cut - it's actually 1%!

That's a real surprise. Admittedly, not all of it is being passed on to

borrowers; but even so, it's had an immediate impact - the Aussie stock

market started to pick up immediately, and finished the day on a much

happier note than anyone had thought possible.

So while the US bailout appears to have no effect (no positive

effect, anyway), just putting a bit of extra cash back into the pockets

of Joe Public down here has performed a minor miracle! I'm just wondering

- is it remotely possible that some of our "big nobs" are actually

reading and taking notice of my website? Or is it just coincidence...?

UPDATE, Saturday 25th October 2008

I like computers. My first experience with a computer was in 1971, my first

year at university, when for the first time a small subject worth three

points (a full year's study was 36 points) named "Introduction to Computing"

was offered by the Uni. of Tasmania's Mathematics Department.

I enjoyed the subject. We were taught to program in Algol. This was the

language from which PASCAL later grew; whereas PASCAL is a schoolmarmish

language which promotes "good" programming habits over everything else, with

heavy emphasis on such things as top-down modular programming and structure,

and strong disapproval of "spaghetti programming", Algol was a "nerdy"

language essentially designed for scientific use. Its "arcane-ness", and the

ability to do neat tricks within it, appealed to me greatly.

"The Computer", an Elliott 503 machine, was housed in the chemistry

building. The main unit was a rectangular block like a large fridge on its

side, complete with blinking lights and a tape reader which accepted

information (programs and data) in the form of rows of eight holes at a

time (one byte), previously punched in a paper tape using a large, noisy

typewriter-like machine called a

flexowriter.

The tape was rolled up using a special gadget with

a crank-handle, and fed into The Computer, which read it and then spat the

tape out very dramatically, ready to be rolled up again. The Computer would

"think" for a little while, and then a tallish, clattery object called a

line printer,

attached to The Computer by a cable, would spring into action, and you'd

get your printout. Oh, yes - those were the glory days!

Actually, the students weren't allowed to use the computer directly. (The

only reason I know what it actually looked like was that the staff held an

"at-home" one evening early in the year, when we were all served coffee in

pyrex chemistry beakers - new ones, we were told!

We were required to write our programs by hand, put them in a large brown

appropriately-marked envelope, and place them in a cardboard box in the

Maths Department labelled

JOB PUNCHING

A day or two later, you'd collect your envelope containing your original

hand-written program along with a typed-up version and a rolled-up paper

tape, both produced by a member of the office staff using a flexowriter,

from another cardboard box labelled

PUNCHED JOBS

Also in the envelope would be a printout resulting from a run of your

program; with a bit of luck it had "worked" and given you the result you

wanted (very unlikely, for the first run at least!). You had three chances

(or was it only two?) to edit out any progamming errors and put it through

the system again; the final result, complete with the most recent program

listing and paper tape, was to be placed in a third box for assessment by

the due date. (I can't remember what that third box was labelled; it might

have been

JOB SUBMISSIONS

- or something similar).

I've just done a bit of Googling to try to find some pictures of an actual

Elliott 503. Most of what I found didn't really ring any bells in my mind,

particularly regarding the "large fridge on its side"-type object that I

thought I remembered. On

this

web-page, you can see a photo of at least some of the components that made

up one of these beasts. I'm wondering whether the large cupboard-type thing

behind the desk is perhaps the main unit. (Or maybe the one I saw was a

different model.)

One thing that is worthy of note is the hand-cranked paper-tape winding-up

thingy that you can see on the left-hand side of the desk. That, at least,

seems familiar!

When the internet arrived on the scene in the 1990's, there were posts

from users proclaiming that we should fight to keep it purely for free

exchange of information, decrying any suggestion that there should be

commercial activity on it. As long as it was all

Usenet

and

FTP,

that was pretty much how it was; but once the web arrived (via a program

called Mosaic, an early version of Netscape) and you no longer needed to

be a nerd - or even a geek - to get involved, it wasn't long before the

financial floodgates were opened.

- And here we are, not much more than a decade later, and just look at the

result. Click

here

to see another web-page addressing the issue. That web-mistress (I

dislike the trendy terms "blog" and "blogger") addresses the issue of how

what is supposed to be "wealth" is now merely bits, bytes, and glowing

pixels on a computer screen, with no real, substantial existence at all.

(Just hot air and BS, as I said earlier.)

She also uses the term "Humpty Dumpty world economy". Actually, it's very

easy to find lots of web-pages which refer to "the economy" in

Humpty-Dumpty terms. (Have a look at

this page,

for example.) Then again, only a few days ago, I saw on TV a senior US

financial figure (I can't remember precisely who) saying "We have to put

Humpty Dumpty together again" (or something very similar).

On yesterday's TV news, we saw former US Federal Reserve chief Alan

Greenspan admitting - finally - that he got it wrong. In the

unlikely event that you missed it, click

here

to read all about it.

For far too long, the people on whom the financial world has relied to

regulate its affairs have adopted a "hands-off" or

laissez-faire attitude, in the hope that the "players" would

regulate themselves; and, of course, it hasn't happened. Instead, greed

has ruled for many years, and now we are all paying the price. (It's not

just me saying this, although I have been saying it for a very long time -

the "movers and shakers" are now actually admitting it themselves! What

took them so long??!)

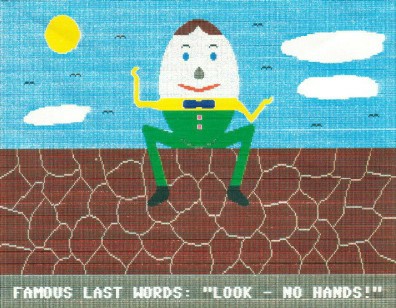

The above graphic, which I created many years ago on my old Commodore 64,

has appeared earlier in this website, in my

Humpty Dumpty Book

page. I thought it was appropriate to give it another airing here.

So - do we just put Humpty Dumpty together again?

- And re-live all this nonsense, a few years or decades later? From my

perspective: no, thanks!!! That particular incarnation of Humpty Dumpty is

dead.

I'll be frank: as far as I'm concerned, economics as a field of human

endeavour has failed us. If we just patch things up and carry on as usual -

if we refuse to learn from our mistakes - it will simply serve us right

when it all goes pear-shaped again next time. I've already had a fair bit

to say about it in these pages; and I'm convinced that recent events have

proved me right. We simply have to find a better way.

We ordinary citizens - the "Joe Public"'s or "Joe the Plumber"'s of this

world - deserve better. Let's work toward a just solution, and then never

allow the rich, greedy and irresponsible to wreck our world again.

UPDATE, Sunday 30th November 2008

Every so often I browse through this website, mainly looking for outside

links I've included that don't work any more. Sometimes I find one; if

possible, I'll generally try to fix it by Googling to see if its URL has

changed. Occasionally I find a link whose target seems to have completely

disappeared. (On the positive side, rarely I'll find one that's gone away

and then come back later!)

[I'm rambling again, aren't I? Back on track...]

Just today I've read through my

All that glisters

page, which contains

one of my rants about matters economic. That page starts out by talking

about gold, and then moves on to other matters - in particular, the stock

market.

One reason for revisiting the page was that someone I know mentioned

yesterday that, with the current global meltdown, people are taking an

interest in gold again. Apparently this information came from something

called "Daily Reckoning". I just typed that into Google, along with "gold"

- and

this page

popped up. Apparently it was posted on 5th June this year (2008), when

all the current trouble was just starting to look like something really

serious.

I'll admit, I can't really figure out what that page's author is on about.

Unless I'm mistaken, he/she seems to be championing gold as an investment

- or am I missing some subtle irony? (See what you make of it!) But more

to the point: while looking through my "glisters" page, I revisited a link

I put there when I posted the page in 2006. That's one link that (at the

time of writing) still works; and in the light of the current crisis I

think it's well worth a look, if you haven't seen it before - or even if

you have, because it's right "on the button". Here's its URL:

https://newint.org/features/1998/10/05/introduction

UPDATE, Thursday 12th September 2019

Almost eleven years later, while browsing through my website looking for external links that don't work any more, I'm delighted to find that the New Internationalist link above still does work; and it's still just as relevant now as

it was then - perhaps even more so, especially in the wake of the recent

Royal Commission into the Australian banking and financial services

industries.

Just to give an idea of the sort of thinking expressed therein, and perhaps to prompt you to visit that page if you

haven't yet done so, here's a short quote which I think pretty much sums the matter up:

... economist John Maynard Keynes found the accumulation of money for its own sake to be morbid, even pathological. Sigmund Freud, true to form, pointed out how a small child who wanted to retain his or her precious faeces might in later life want to hold on to money.

'Nuff said???

Strange days indeed...

"There's a UFO over New York and I ain't too surprised"...?

)? Precisely

this:

)? Precisely

this:

) Read on from there.

UPDATE - fix up later

https://www.youtube.com/watch?v=XxyB29bDbBA

=> link to "Fidelity Fiduciary Bank"; old link exists in that page but has gone - this one works (19-10-2018)

) Read on from there.

UPDATE - fix up later

https://www.youtube.com/watch?v=XxyB29bDbBA

=> link to "Fidelity Fiduciary Bank"; old link exists in that page but has gone - this one works (19-10-2018)

) Special

provision was made for economics students, who were sometimes referred to as

"eco-wackers".

) Special

provision was made for economics students, who were sometimes referred to as

"eco-wackers".

)

)

fall in the sea

eventually...

There's got to be something better out there.

Love and compassion, their day is coming;

All else are castles built in the air -

And I wonder when we are ever gonna change,

Living under the fear till nothing else remains..."

-

and allowed to see the monster in operation.)

-

and allowed to see the monster in operation.)

UPDATE, 24th April 2016

My goodness - how things have changed.

Return to Unequivocal ursine utterances menu

Return to Unequivocal ursine utterances menu